Gold Bar – 5 Oz, .9999 Pure, Miscellaneous Design

11.313,25 $

| Quantity | Premium/Oz | Total Price Each |

|---|---|---|

| 1 – 1 | $79.00 | $11,313.25 |

| 2 – 3 | $72.00 | $11,278.25 |

| 4 – 10 | $65.00 | $11,243.25 |

| 11+ | Call for discount | |

- Bitcoin - 2%

- Description

- Reviews (0)

- Specifications

Description

Beautiful 5 Oz Gold Bars From Money Metals Exchange

Owning gold is an important step toward true diversification and protecting your wealth from the ravages of inflation. That is why it is important not to get “hung up” on which item to buy.

There are hundreds of gold bullion products from around the world. Choosing which to purchase can seem daunting, but it needn’t be. It is as simple as choosing whether you prefer the lower-cost rounds and bars, or the trust and recognizability of government-issue coins. Then select from among the most popular (and liquid) items in that category. Stay well away from collectibles, unless you know your stuff. If you do these things, it is very hard to go wrong.

Investors who are focused on buying gold at the lowest cost should take a look at 5-oz bars. It is one of the larger-sized bars to be widely traded outside of the futures markets. That means manufacturing gold bar cost are lower on a per-ounce basis and buyers will save money on the premium they pay per ounce according to the gold market.

See below as to why the 5-oz. gold bar is popular, and compare its availability and accessibility to other bars and bullion coins. We will also explain premiums and why prices vary slightly from one gold bullion product to another.

The 5 Oz Gold Bar

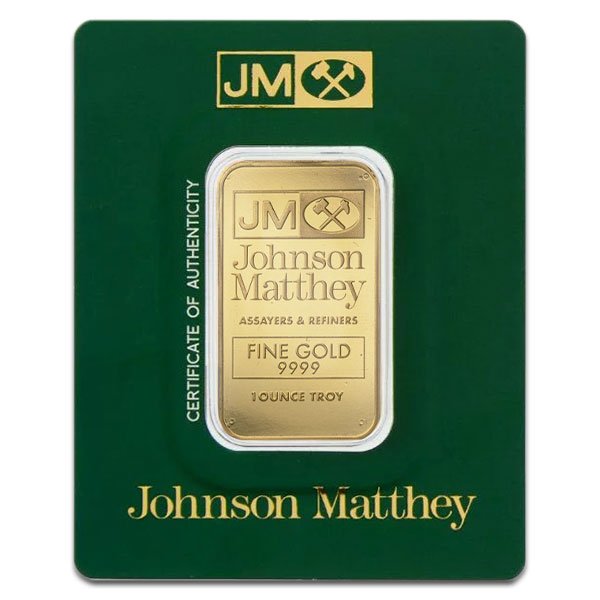

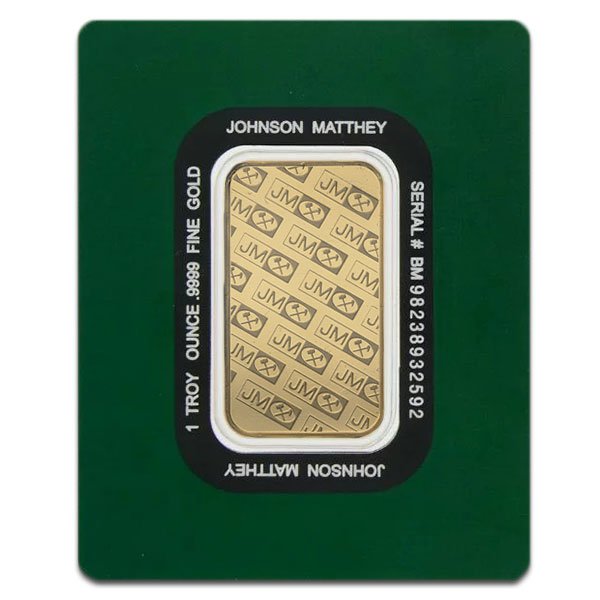

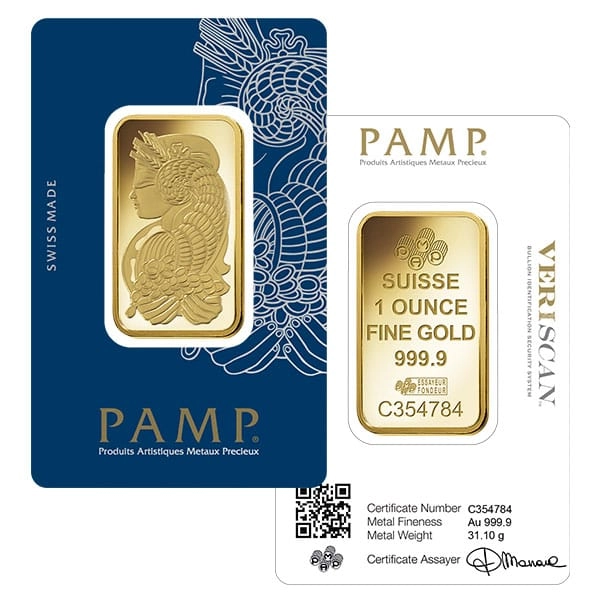

There are several gold bar manufacturers around the world. The Swiss refiners, PAMP Suisse, and Credit Suisse, are both premier names. Italian refiner ITALpreziosi recently introduced their bars in the US market. The Royal Canadian Mint is one of the sovereign (national) mints producing bars this size. Australia’s Perth Mint rounds out the list of refiners whose bars are most widely traded.

The design of the ITALpreziosi bar is typical in terms of design elements. The refiner’s logo is stamped on the front. Each bar is also stamped the 999.9 purity, the weight at 5 troy ounces, and a serial number. The bar includes a card certifying the bar’s authenticity.

Gold bars, including the 5-oz size, are designed for investors and not for collectors. They are produced in bulk and intended to be sold as close as possible to the gold’s melt value. The price of a bar, as of this writing, is approximately $10,000 – not a trifling sum. This product appeals most to people looking to build a significant position in gold.

Five-ounce gold bars are easy to find, though smaller bullion dealers may not have a large inventory on hand. Whether you are looking to buy several or you want a single bar for your stack, Money Metals Exchange will be able to accommodate your needs.

5 oz Gold Bar Premiums

Premiums are a part of bullion trading, but people entering the market for the first time often aren’t familiar with what they represent. Allow us to explain.

There are two components to the price of any bullion product. The first is the “spot” price for the underlying metal. This is the price people most often see quoted – in the newspaper or on financial TV. The other component is the “premium”. This includes the cost of taking the raw, purified gold and converting it to finished bars or coins. It also includes the bullion dealer’s profit. And, if the dealer bought the item from a wholesaler and paid a premium, that will be included.

Fortunately for investors, the bullion market is extraordinarily competitive and premiums are driven down by market forces. In general, 5-oz. gold bars come with a lower premium than gold bullion coins. This is in part because government mints charge more than private refiners for producing the coins. The larger unit size also helps. The cost of manufacturing a 5-oz bar is nowhere near 5 times the cost of producing the equivalent weight in 1-oz bars.

This lower cost makes five-ounce bars a great investment vehicle. Lower up-front costs can mean better returns on your investment.

5 oz Gold Bar vs. Gold Bullion Coins

Although 5-oz. gold bars are attractive due to the lower premiums, they are not as popular or widely traded as the most popular gold coin 1 oz. It is safe to say that the gold bar will cost less per ounce to buy, but it will also bring less when it is time to re-sell. For investors who want maximum liquidity, the gold coins from the US and Canadian mints are hard to beat.

The bars will offer the lowest overall price per ounce of gold. They may also be more efficient to store if space is very limited. There is a “cool” factor.

After setting aside costs, the primary difference between bars and coins is one of aesthetics. Some investors will choose coins over 5-oz. gold bars because coins have widely varied designs and can offer some historical or ideological interest. Other investors will prefer the look of bars. And, perhaps most often, gold fans will accumulate some of both.

Conclusion

Five-ounce bars are a great option for buyers whose main priority is to buy gold at the lowest possible price per ounce. The certification included with the bar will provide some assurance that the bar is genuine.

We don’t often recommend gold investors begin their holding with a bar this size. Smaller 1-oz coins and bars are more affordable and more versatile in that they can be resold an ounce at a time. But 5-oz bars are a great addition to any holding which already includes some smaller units.

Only logged in customers who have purchased this product may leave a review.

| Mint Facility: | Various |

| Purity: | 99.99% Pure Gold |

| Metal Weight: | 5 troy oz. |

Reviews

There are no reviews yet.